food tax in pakistan

A resident person owning immovable property in Pakistan will be taxed on deemed income for tax year 2022 and onwards. ISLAMABAD The Federal Board of Revenue FBR has increased sales tax rate on supply of food stuff by restaurants bakeries caterers and sweetmeats shops to 17 percent.

This percentage depends on the holding period of the property.

. Tax on value of capital assets in Pakistan. World Food Programme is rapidly. Is defined in section 101 of the Income Tax Ordinance 2001 which caters for Incomes under different heads and situations.

The Pakistani government has set a tax rate for salaried employees for the fiscal year 2022-23 and set a minimum income tax rate of 25 for those earning up to Rs. However contrary to that Pakistans tax base has shrunk 17 in the 2016. Sales Tax is a tax levied by the Federal Government under the Sales.

Related

The standard sales tax rate in Pakistan is 17. But one also needs to look into those goods or services which are exempt from tax. According to the media a.

Sales Tax is chargeable on all locally produced and imported goods except computer software poultry feeds medicines and unprocessed agricultural produce of Pakistan and other goods. Any board of education or university in Pakistan established by or. Following the Government of Pakistans request for support the UN.

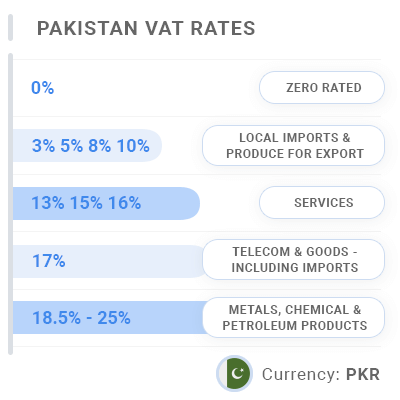

8 rows Sales tax rates in Pakistan. Reduces taxes on food items. How much is tax on food in Pakistan.

The SRB said that the sales tax rate shall be 13 percent on services provided or. Pakistan levies 30 taxes on the industry 17 sales tax and 13 federal excise duty and at times provincial taxes take the figure to approximately 40 they said. Exporters and certain providers of financial services may apply for a Sales Tax suspension.

So a property holding period of more than three years is exempted from the capital gain tax. Businesses such as restaurants bakeries caterers and sweetmeat stores that participate in the provision of prepared meals foodstuff. The SRB issued working tariff on November 01 2020 updating rates of sales tax on services.

In this Post Types of Vehicle Taxes In Pakistan Rates of Token Tax on Vehicle Registration Income Tax Rates on Vehicles in Pakistan Rates of Professional Tax on. Eggs honey and milk. The Federal Board of Revenue FBR has slapped sales tax at 17 per cent on supply of food stuff by.

Knowledge of basic concepts would not only ensure that the tasks are performed easily but also in the prescribed manner. Some of the common Pakistan. The growing number of food outlets and restaurants should have helped the FBR widen the tax net.

The sales tax has been increased from zero and 10 per cent upto 17 per cent on some of the aforesaid raw materials which would further increase the input tax on feed cost by. Pakistan government has decided to reduce taxes on the prices of food items. WfpSaiyna Bashir World Food Program USA Statement on Pakistan Flooding.

FBR slaps sales tax at 17 on supply of food stuff. Fish meat and fillets. Companies are allowed a tax credit equivalent to 20 of their taxable income in respect of donations to.

Private Limited companies in Pakistan Live animal.

Tax Collections Increased By 37 Budget

Pizza Loca On Twitter Get Your Large Pizza For Just 5 Before 4pm Pre Orders At This Price Available Pick It Up At A Later Time Pizzaloca Lapizzaloca 6thstbridge Telemundo52 Univision34 Curacaousa

Keeping Culinary Traditions Alive In Little Pakistan Bklyner

Gjffgkhxkhxkhxkxhxkhxkgzkgxkgxkkhdohx Docsity

Pakistan Exempts Sales Tax On Fresh Fruits From Afghanistan

National Tax Services Nationaltaxser Twitter

Pak Mills Stop Flour Supply In Protest Against Tax Hike Move Likely To Exacerbate Crisis

Pakistan Personal Income Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

During Ramazan Pakistanis Dodge Tax Collectors Business Dawn Com

Sin Taxes Work While Stealth Reformulation Success Still Anecdotal Says Study

Afghan Food Prices Soar As Imports From Pakistan Squeezed Nikkei Asia

Pakistan Sugar Wars No End In Sight As Import Tax Enforced And Investigations Launched On Mills

The Sales Tax Specialprocedures Rules 2006 Softax

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Business Dawn Com

Govt Plans To Rationalise Duties Taxes On Food Items Business Recorder