pay indiana property taxes online

Pay Property Taxes Online. Ways to pay your taxes.

Pennsylvania Property Tax H R Block

The transaction fee is 25 of the total balance due.

. Pay by phone toll free. Take the renters deduction. November 10 2022 401 S Adams St Suite 229.

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. Taxes not paid on or before the due date are subject to penalty. The treasurer settles with township and city treasurers for taxes collected for the county and state.

Pay my tax bill in installments. To search for multiple properties with different last names within the same search enter both last names. E-Check Visa Mastercard Discover and American Express accepted.

Payments are not posted until they are received by the Hendricks County Treasurer. This option allows taxpayers to pay online as well as view their complete tax bill payment history and property card. Building A 2nd Floor 2293 N.

The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow. FirstNameJohn and LastName Doe OR. Search Any Address 2.

Look up the property with all relevant documents attached to each parcel. Find Indiana tax forms. Online Tax Resources Paperless Billing Pay Taxes Online Paperless Billing Pay your property taxes online through Invoice Cloud.

Have more time to file my taxes and I think I will owe the Department. The Treasurer is located on the top floor of the Government Center at 355 South Washington Street 240 Danville IN. Use Address Example.

Tax Bill Information Online Payment Options. May 10 2022 Grant County Treasurer. Use the Property Reports and Payments application to make online payments.

You can now pay your property taxes online by electronic check with your checking or savings account online with no additional fees. You can even setup automatic payments to pay your Spring and Fall installments or you can setup monthly payments to make it easier to budget for your property taxes. On Tax and Payments Payment Details page click on the button Pay Now.

Follow the directions online. Find Records For Any City In Any State By Visiting Our Official Website Today. The fee for a credit card payment is 295 with a min fee of 100 and the fee for an e-check is 95.

To View Tax Bill and other Property Tax info. Print a Tax Bill Payment Options Change a Mailing Address. Property Tax Payments - Search.

There is a convenience fee for this service go to Tax Payment Conditions for more complete details. A drop box is located on the south side of the Government Center building next to the door located in the center. You can search by Name Address Duplicate Number or Tax ID Number.

See Property Records Tax Titles Owner Info More. Review all public property tax information through the GIS system. Claim a gambling loss on my Indiana return.

All this at no cost to you. To view and pay your 2021 pay 2022 Property Tax Bill. Center 220 N Main St Kokomo IN 46901 Open Monday-Friday from 8am-4pm webmasterhowardcountyingov Join Us Online.

Both the 1st and 2nd installment tax bill payment stubs are included. Please direct all questions and form requests to the above agency. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Try our new website at. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. File Homestead and Mortgage Deductions Online.

Review and select the propertyparcel you wish to make a payment towards. Transaction Fees are Non-Refundable. Due dates are on each installment statement.

To pay online visit eNotices Online or to pay by phone call 877-690-3729 and use Jurisdiction Code 2413. Please contact the Indiana Department of Revenue at 317-232-1497. Transparency in Coverage TIC General Contact Info Howard County Admin.

Main Street Crown Point IN 46307 Phone. We are excited to offer our taxpayers another way to pay their bills. Property with a total tax bill of 2500 or less will be billed the total due on the 1st installment.

Call 855-423-9335 with questions. Use First Name Last Name Example. Ad Look Up Any Address in Indiana for a Records Report.

To pay your bill online scroll down to the bottom of the screen and search for your parcel. Choose real estate personal or mobile home property tax. To pay with the automated phone service you will need your duplicate number which can also be found at eNotices Online or in the upper left portion of your spring or fall coupon.

This search may take over three 3 minutes. Pay your real estate property taxes online or pay by phone at 877-571-1788 Visit the Treasurers Office home page. This tax payment and escrow system will allows mortgage escrow and title companies to create a portfolio of properties for which you are responsible to pay property taxes and make one.

Know when I will receive my tax refund. Update Tax Billing Mailing Address. This is NOT managed by our office.

You may also go to vanderburghcounty82us to view your tax information. More information is available in the Electronic Payment Guide. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Tips and notes about searching for your parcel. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction. Use 18 Digit Parcel Number Example.

100 W Main St OR. Call our office at 812 435-5248. Tax bills are mailed once a year.

Tax bills will be mailed by April 15 2022 -Mail tax payments to. Spring property taxes are due Tuesday May 10 2022. 183335552227774003 Numbers Only Please use only 1 Search Option at a time.

See Results in Minutes. The program is available through the Indiana Homeowner Assistance Fund IHAF. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more.

This is a fee based service. Elkhart County is excited to offer residents an easy and convenient method to view and pay their real estate personal property and mobile home tax bills online. Full and partial payments accepted.

The treasurer collects real personal and mobile home.

How To Read Your Property Tax Bill Community Development

2022 Property Taxes By State Report Propertyshark

Property Taxes How Much Are They In Different States Across The Us

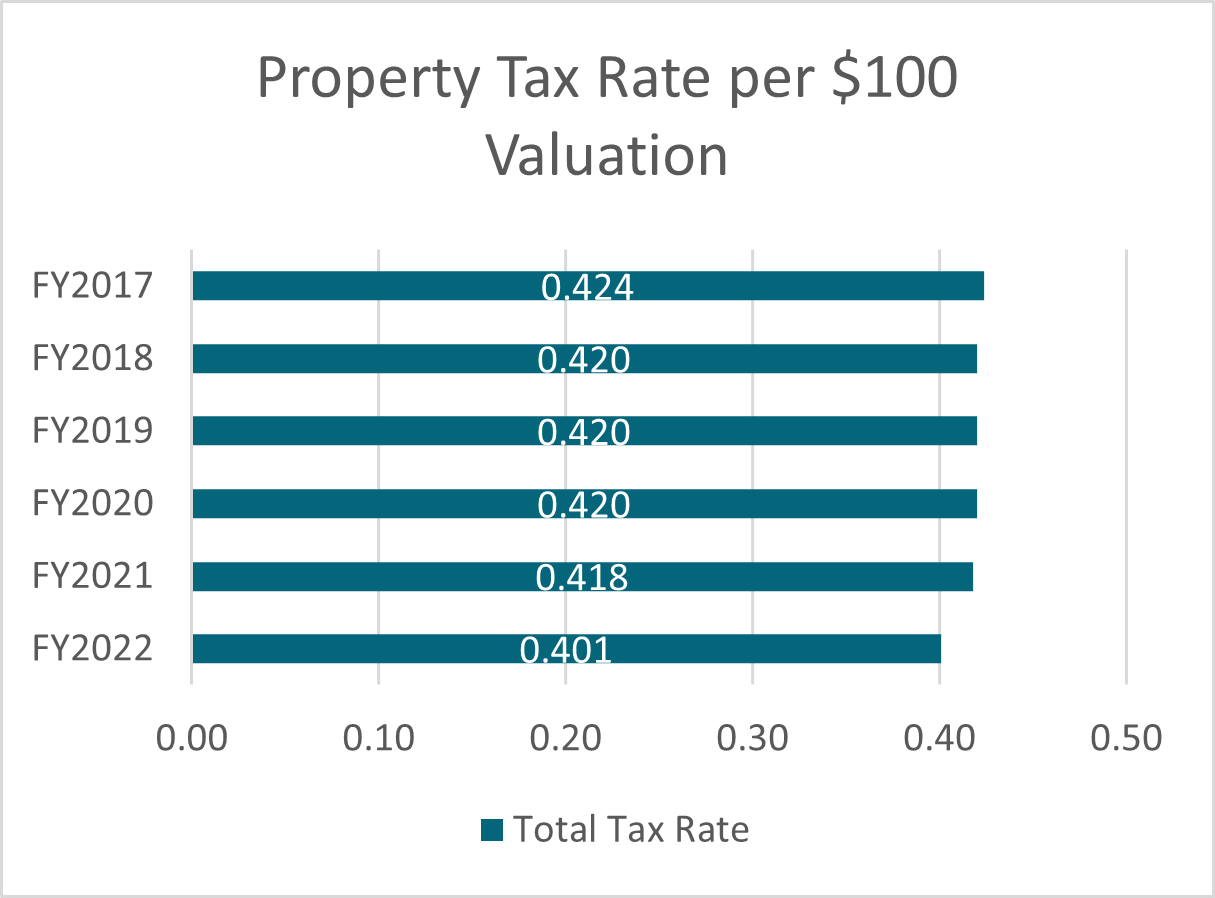

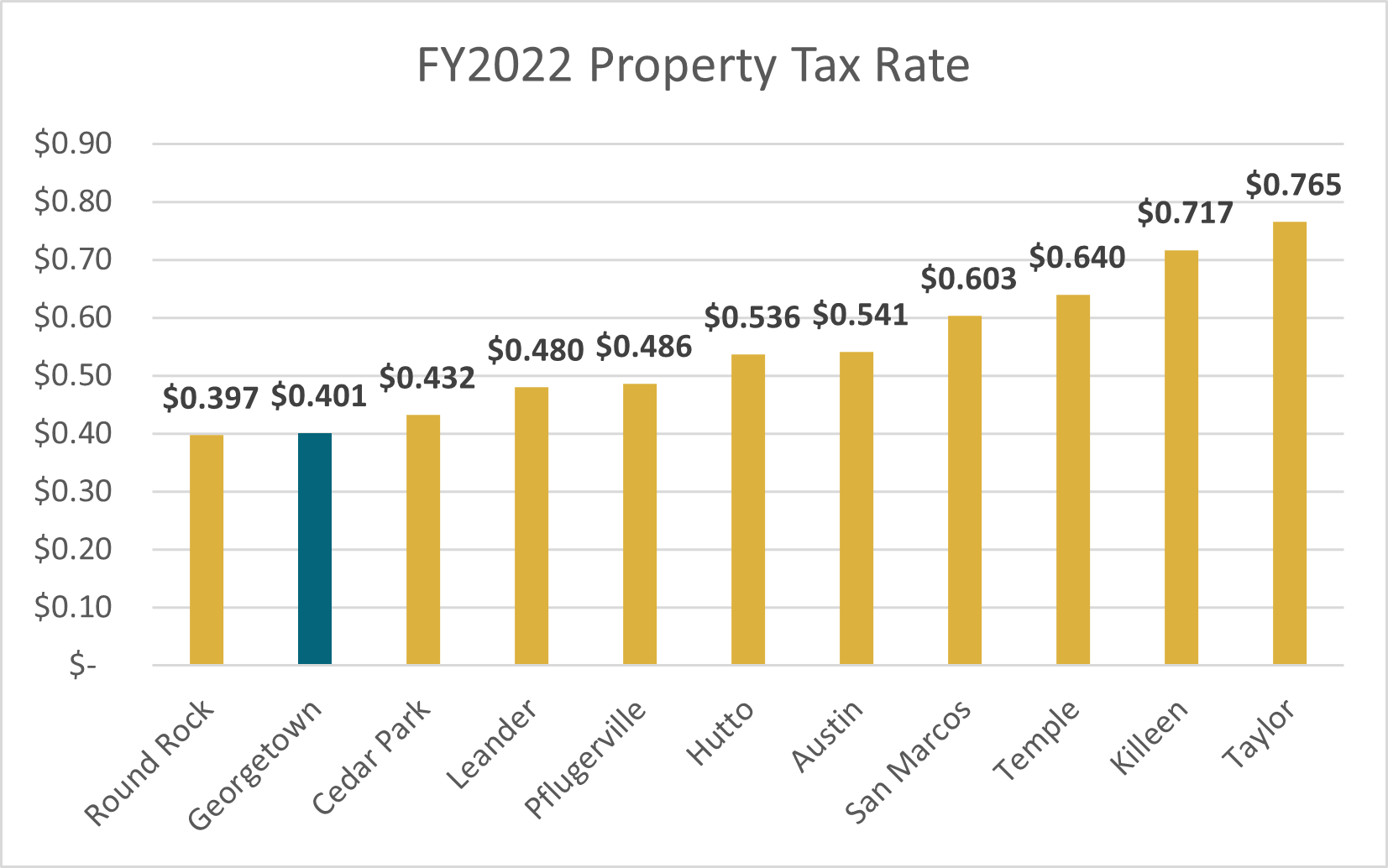

Property Taxes Georgetown Finance Department

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax How To Calculate Local Considerations

What Is A Homestead Exemption And How Does It Work Lendingtree

How Taxes On Property Owned In Another State Work For 2022

Property Taxes By State County Lowest Property Taxes In The Us Mapped

How To Accrue Estimated Property Taxes In Quickbooks Online Youtube

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg)

How To Pay Your Property Tax Bill

How To Accrue Estimated Property Taxes In Quickbooks Online Youtube

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State Small Towns Usa

Property Tax Appeal Tips To Reduce Your Property Tax Bill

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)